Boeing – Destination Disaster? – Adam Warren

The Boeing 737 Max – Destination disaster?

On Tuesday the UK’s Civil Aviation Authority (CAA) said it was banning the Boeing 737 Max from the skies of Britain, joining other countries including China. The European Union and India have also today banned the Boeing 737 Max from flying over their airspace to ensure passenger safety. They are all joining a long list of countries in suspending the plane. Yesterday evening, President Trump announced that the US would also be grounding the aircrafts. After the US and Canada made this move today, Boeing the announced they will suspend all models of the 737 Max planes.

![]()

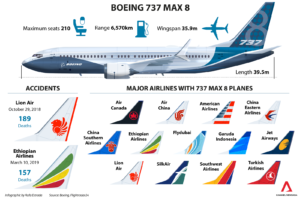

It comes after an Ethiopian Airlines plane crashed on Sunday, killing 157 people on board, it was the second fatal accident involving the 737 Max 8 model in less than five months. India’s Ministry of Civil Aviation announced that it would ground the Boeing 737-Max planes “immediately”, with the EU Aviation Safety Agency which said it is suspending the aircraft “as a precautionary measure”. However, US officials say the aircraft are still safe to fly, despite the US Association of Flight Attendants-CWA union calling for the Federal Aviation Administration “to temporarily ground the 737 Max fleet in the US out of an abundance of caution”. But what is all the fuss about? Is the Boeing 737 Max actually dangerous? And what does this all mean for passengers, airlines and Boeing?

How does it affect Boeing (BA on the Stock Market)?

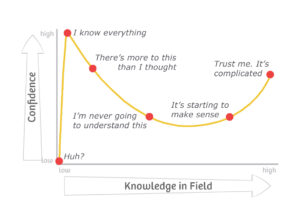

The impact for Boeing is very serious. Despite their share price being up 32% this year, the morning of the Ethiopian Airlines crash saw an 8% drop in price. This is relatively normal for airlines or aircraft manufacturer’s shares to fluctuate following accidents, and following Dennis Muilenburg, president, chief executive and chairman of Boeing, said: “We are doing everything we can to understand the cause of the accidents in partnership with the investigators, deploy safety enhancements and help ensure this does not happen again’, Boeing’s share price rose again today it is up 1.73% to $377 (Before the Ethiopian Air crash it was over $400. However, the company’s market value has dropped by nearly $26bn since the crash in Ethiopia at the weekend. Boeing is arguably too big a brand to fail however, and thus it will continue to be supported by larger American companies and businessmen meaning they are likely to survive the 737 drama with nothing more than a few more bruises to their relatively clean safety record.

How will it affect me and other passengers flying around the world?

For customers the impact is less disruptive then it could have been. Actually very few airlines operate large fleets of the 737 Max, as its purpose is for shorter haul domestic flights.

What is even the problem?

Basically, the Boeing 737 features new safety equipment that ironically is doing the opposite. The plane features technology aiming to align the nose of the plane in order to make it less likely to drop in altitude unexpectedly. However, Pilots in the US had complained late last year about problems controlling the Boeing 737 Max 8 during take-off.

They reported difficulties similar to those that contributed to the fatal Lion Air crash in Indonesia in October. The similarities between October and the Ethiopian Airlines crash are what is causing all the concern. Both crashed minutes into its flight, both had unstable altitudes as well as a myriad of technical similarities.

Ultimately, it should be noted that you are actually 10x more likely to be killed in a fatal traffic accident on the way to the airport then in the sky, it is just the loss of life involved in air disasters are why we hear about them. However, the potential technical problem with the 737 Max is certainly an issue but given none are in the skies at the moment, travel continues as normal.

I am a Contributor for the RHS Bubble

Post Comment

You must be logged in to post a comment.