An argument against cryptocurrency – Alfie Christopher

The crypto currency market is a “collection of concepts and technologies that form the basis of a digital money ecosystem.” By purchasing one unit of crypto currency, one is purchasing a piece of data secured by cryptography. The value of this data fluctuates in the same fashion as the British £ or the US $.

The reason why this is important is because Manufacturers of digital money perceive the long term objective is to completely render money as we know it today and covert all transactions online in the form of cryptocurrencies. Therefore its important to identify weather this concept is good for society or not.

The attractive merits of crypto currencies is the fact that it removes the middle man when managing finance. No longer do you have to trust a third party such as a bank, you can instead have a stable technology based store of value. It is effectively putting finance into the hands of a robot. When we put money into a bank account, we have to trust the bank to not collapse or else we may lose some of our savings we put in.

In 2008 American Banks such as the Lehman Brothers went bust leaving a lot of individuals with less money. As a result of this, more and more individuals are looking to save their money in alternative methods. The crypto currency provides that other method. Economists at the University of Exeter predict that 15% of banks are likely to adopt the blockchain. J.P Morgan are preparing to launch a new crypto currency similar to Bitcoin.

Due to the increasing computing power, the blockchains which make up the algorithms are difficult to hack into. At the moment it is completely decentralised with no government red-tape or intervention. And the market operates in a simple way with a lender and a recipient.

However the reason why this potentially forward thinking idea is fundamentally flawed is its insane energy consumption. In order to maintain the security of algorithms it requires energy to keep the data safe. Bitcoin alone at its peak consumed an annual rate of 2.5 gigawatts (GW) same energy consumption as the nation of Ireland. In the context of our sensitive environmental concerns, a platform like this makes it seem infeasible to continue. Why is it so much? Increasing the supply of crypto currencies is called mining. This requires faster computing power. Not only does each coin cost more energy, the rate of each virtual coin costs more energy. More complicated blockchains are required.

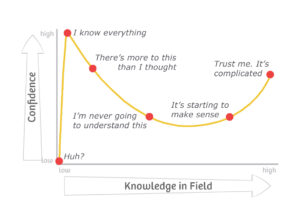

Another issue is how volatile the price of crypto currencies can be. Bitcoin makes up 86% of the crypto currency market. The pattern of Bitcoin is an example of an asset bubble. This is when the price of something continuously rises due to speculation until it steeply declines. The fact is it was a currency intended to act as a medium of exchange. Instead its 90% of purchases made are for speculative purposes. In the space of a year the value of Bitcoin went from $900 to $19000. The value of it now. Just over $4000. Those who bought at the top price end have ended up with one of the worst performing assets.

One Crypto currency I’m going to talk about is one called Money buttons. This uses the same concept of decentralisation but the unique thing is that money can be exchanged via text. This increases the anonymity of the transaction and makes the market more accessible. No internet connection is required. Therefore if 3rd world countries who struggle to access internet adopt Money buttons. They don’t have to rely on their potentially corrupt banking systems. Therefore it is a good source of finance with no diversion between the lender and the recipient.

Going back to the idea of crypto currencies replacing all forms of money. In the context of Brexit, environmental deterioration and worsening international relations the mass adoption of crypto currencies is an unwise idea. What governments should do now is find ways of limiting crypto currencies influence. For China forced a bitfarm, to move out of a region using under-utilised hydro electric plant and connected the bitfarm to the main grid. => Making companies pay higher for their energy company. The fact that they’re internalising the externality of crypto currencies is a step in reducing their influence. It’s a technology which doesn’t scale well. They are unlikely to ever achieve a complete monetary revolution.

Bibliography

Harwick, C. (2016). Cryptocurrency and the Problem of Intermediation. The Independent Review, 20(4), 569-588. Retrieved from http://www.jstor.org/stable/44000162H

Why Bitcoin Uses so much energy: The Economist

O’Sullivan, A. (2018). UNGOVERNED OR ANTI-GOVERNANCE? HOW BITCOIN THREATENS THE FUTURE OF WESTERN INSTITUTIONS. Journal of International Affairs, 71(2), 90-102. Retrieved from https://www.jstor.org/stable/26552331

I am a Contributor for the RHS Bubble

Post Comment

You must be logged in to post a comment.